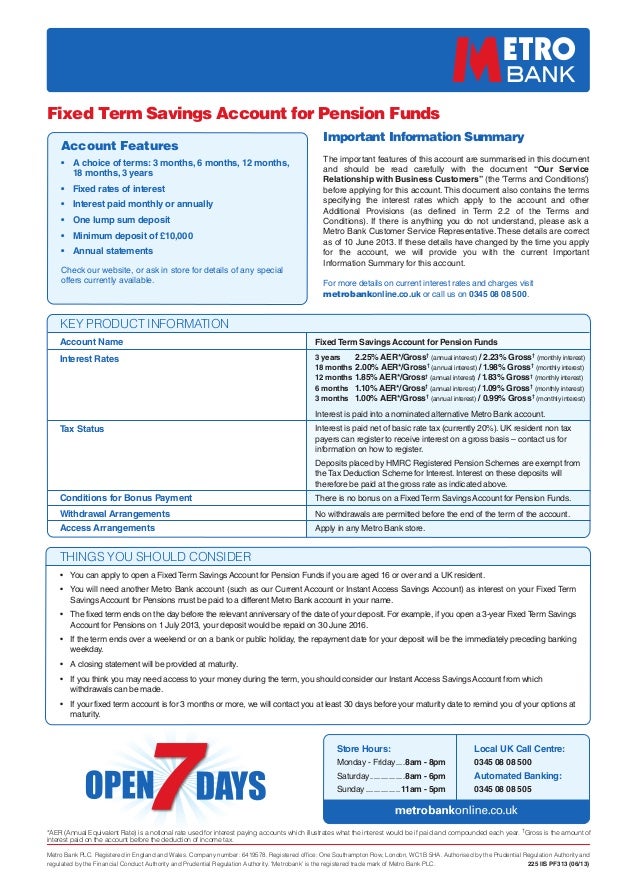

Fixed-rate ISAs are a type of tax-free savings account that you open for a specific period, with an interest rate that depends on the length of your term. These terms typically range from one to five years. It's not uncommon for people to inquire about a fixed rate savings account— or a savings account that earns a predetermined interest rate for a specific time period. While many financial institutions, including Ally Bank, do not offer fixed rate savings accounts, most offer certificates of deposit (CDs), which are savings products with fixed. A fixed rate bond (or fixed term savings account) is a simple investment product that pays out a guaranteed amount of interest after a set period. If you’ve got a lump sum you’re happy to put away and not touch for a while, a fixed.

Lock your money away for a fixed period and get a really competitive interest rate.

Lock your money away for a fixed period and get a really competitive interest rate.

Competitive rates of interest up to 0.80% AER fixed

Minimum opening balance for 2, 3, 4 and 5 year terms: £1,000

View your savings account online whenever you want

Maximum 2 deposits: £250,000 total during first 14 days

Customer limit of £250,000 (can be spread across multiple Savings Accounts)

Apply now to take advantage of our savings accounts and personal loan.

| Interest rate | Term | Deposit | Withdrawals | Account servicing | Interest |

|---|

| 0.55% gross AERⱡ fixed | 1 Year | £100* minimum, maximum £250,000 | None | Online | Calculated daily, paid annually |

| 0.65% gross AERⱡ fixed | 2 Year | £1,000** minimum, maximum £250,000 | None | Online | Calculated daily, paid annually |

| 0.70% gross AERⱡ fixed | 3 Year | £1,000** minimum, maximum £250,000 | None | Online | Calculated daily, paid annually |

| 0.75% gross AERⱡ fixed | 4 Year | £1,000** minimum, maximum £250,000 | None | Online | Calculated daily, paid annually |

| 0.80% gross AERⱡ fixed | 5 Year | £1,000** minimum, maximum £250,000 | None | Online | Calculated daily, paid annually |

| Interest rate | Term | Deposit |

|---|

| 0.55% gross AERⱡ fixed | 1 Year | £100* minimum, maximum £250,000 |

| 0.65% gross AERⱡ fixed | 2 Year | £1,000** minimum, maximum £250,000 |

| 0.70% gross AERⱡ fixed | 3 Year | £1,000** minimum, maximum £250,000 |

| 0.75% gross AERⱡ fixed | 4 Year | £1,000** minimum, maximum £250,000 |

| 0.80% gross AERⱡ fixed | 5 Year | £1,000** minimum, maximum £250,000 |

None

Online

Calculated daily, paid annually

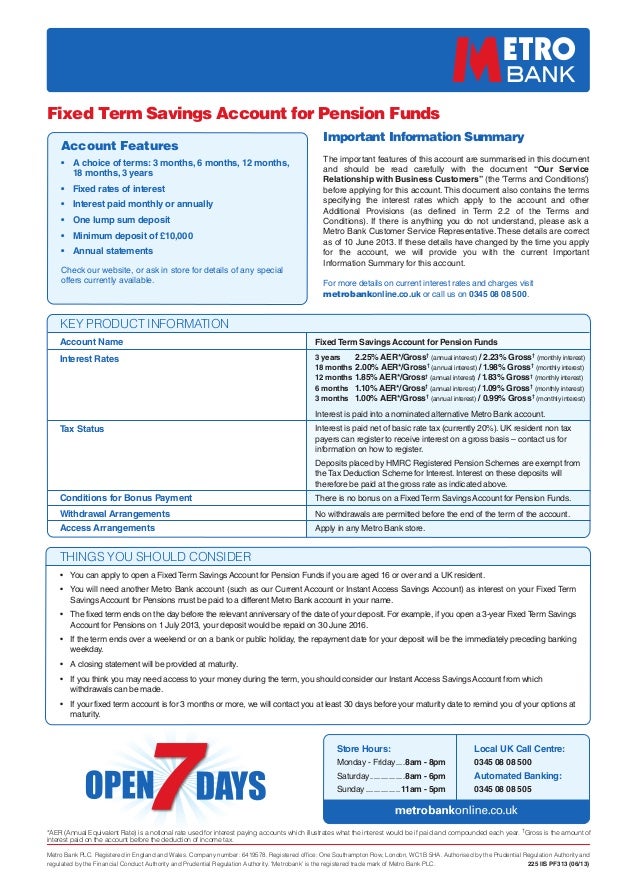

Fixed Term Savings Account

You can apply for a JN Bank Fixed Term Savings account if you:

• Are over the age of 18

• Have a UK mobile phone number and an email address

• Have a UK bank account from / to which you can make transfers

• Transfer at least £100 within 14 days of opening a 1 Year Term, or £1,000 within 14 days of opening a 2, 3, 4, 5 Year Term

Please note: interest is paid annually; there is no early withdrawal entitlement; the account must be opened in sole name only;

Fixed Term Savings Account Barclays

* You can only make two deposits of at least £100; which must be within 14 days, otherwise it will be automatically closed.

** You can only make two deposits of at least £1,000; which must be within 14 days, otherwise it will be automatically closed.

Fixed Term Savings Account Calculator

ⱡ Interest rates are correct at the time of publication but may change in the future.

Summary Box

Long Term Saving Options

What is the interest rate? | Term | Minimum / Maximum Balance | AER / Gross p.a. |

1 year | £100 - £250,000 | 0.55% |

2 years | £1,000 - £250,000 | 0.65% |

3 years | £1,000 - £250,000 | 0.70% |

4 years | £1,000 - £250,000 | 0.75% |

5 years | £1,000 - £250,000 | 0.80% |

- Interest is calculated daily and paid on the anniversary of the initial deposit, to your JN Bank Fixed Term Savings Account.

- You can check the interest rate applicable to your account on any day by logging into internet banking.

- AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if paid and compounded once each year. Gross interest is the interest rate paid without the deduction of income tax.

|

Can JN Bank change the interest rate? | Rates are fixed until the maturity date. For further information please refer to clause 4 of our JN Bank Fixed Term Savings Account Specific Terms and Conditions. |

What would the estimated balance be on the following: | Term | Based on an Initial Deposit of | Projected Return |

1 year | £1,000 | £1,005.50 |

2 years | £1,000 | £1,013.04 |

3 years | £1,000 | £1,021.15 |

4 years | £1,000 | £1,030.34 |

5 years | £1,000 | £1,040.65 |

Please remember that any interest earned on your account is paid annually to your JN Bank Fixed Term Savings Account. This example is provided as an illustration only and does not take into account individual customers' circumstances. |

How do I open and manage my account? | - You can open and manage your JN Bank Fixed Term Savings Account online here or by contacting Customer Services on 0808 196 1945.

- You must be aged 18 or over and be a UK resident to open a JN Bank savings account.

- The minimum amount you can deposit in the account is £100 or £1,000, depending on the term that you select.

- The maximum amount that can be deposited in the account is £250,000

- You must invest a minimum of £100 or £1,000 (depending on the term) within 14 days of account opening to ensure that your account remains open and that you benefit from the advertised rate of interest.

- Once you have opened your account, you can make two lump sum deposits to fund your JN Bank Fixed Term Savings Account.

- No additional deposits may be made after your initial two deposits.

- You can deposit into your JN Bank Fixed Term Savings Account in two ways:

- Transfer money from your nominated account; or

- Transfer funds direct from your existing JN Bank savings account.

|

Can I withdraw money? | - You will not be able to make any withdrawals from this account until the fixed rate period ends.

- We will notify you 21 days before the fixed rate period has ended and ask you what you would like us to do with your money. You will be able to open another JN Bank savings account and have your funds deposited into this new account, or we will be able to transfer your money to your nominated account held in your name with another provider. If you do not provide us with an instruction, your funds will earn interest at the same rate as our JN Bank Easy Access Savings Account until instructions are provided.

|

Additional Information | - The maximum that any customer can hold across their JN Bank Fixed Term Savings Accounts is £250,000.

- You will not be able to close or switch your JN Bank Fixed Term Savings Account before its maturity date.

- We will write to you 21 days prior to maturity to advise you of the options available to you.

- Interest is paid gross.

- If you earn more interest than the Personal Savings Allowance, you may have to pay extra tax yourself.

- The Personal Savings Allowance is £1,000 for basic rate taxpayers and £500 for higher rate taxpayers.

- Additional rate taxpayers don’t receive a Personal Savings Allowance.

- You may need to pay tax on any interest that exceeds the Personal Savings Allowance. Please contact HMRC if you need more information.

- An account with JN Bank in the UK does not confer any membership rights with the JN Group.

|